Whether you want to measure your business success; want to find out its performance and the areas where it needs improvements, you need to implement Key Performance Indicators (KPIs). These are quantifiable metrics to know how well your business is operating to achieve its goals and objectives. Let’s delve into the details of KPIs.

Skyrocket your business revenue with our professional accountants, bookkeepers, tax experts and business consultants at Accounting Firms! Register today in under three minutes – For Free!

What are Key Performance Indicators (KPIs)?

KPIs are the tools to set and monitor the performance of a business against its core goals, objectives and purpose. Effective KPIs should provide an overview of how a business has accomplished its purpose, objective and mission in a given period.

KPIs vary from business to business and are used by almost all businesses to track the business progress in a specific time frame. By measuring them, you can better understand your business from top to bottom, which helps you to make better strategic decisions.

Types of KPIs?

There are many types of KPIs that you can choose as per your business needs. These include:

- Quantitative indicators

- Qualitative indicators

- Lagging indicators

- Leading indicators

- Input indicators

- Process indicators

- Output indicators

- Directional indicators

- Financial indicators

- Practical indicators

- Actionable indicators

What Does KPIs Include?

Many things are involved in KPIs. Here are the factors on which KPIs are based:

- Business Indexes

- ROI (Return on Investment)

- Financial Indicators

- Satisfaction Metric

- Customer retention

- Call times

What are Financial KPIs?

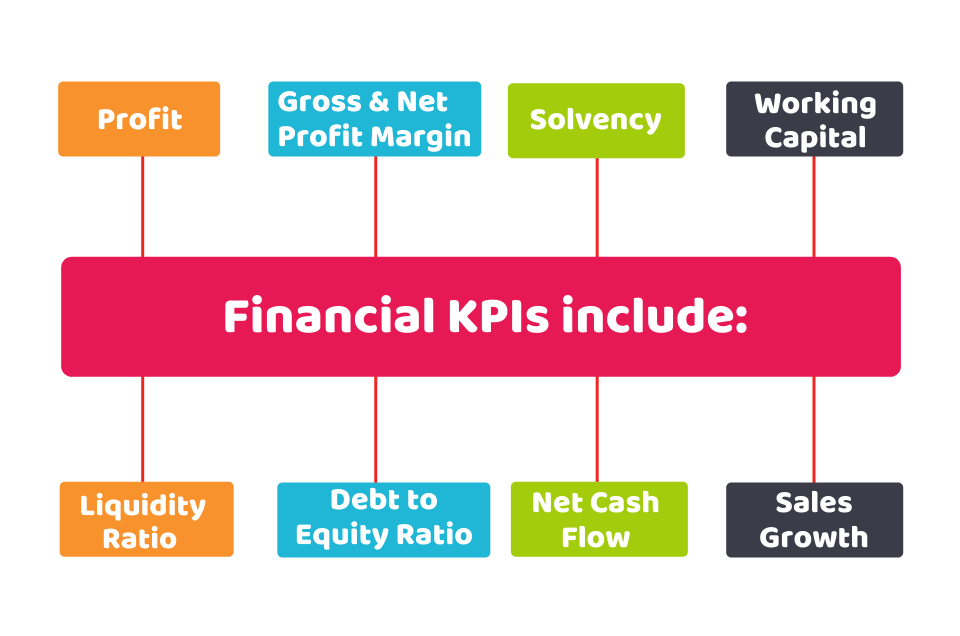

Along with other KPIs, financial KPIs play a key role to track and analyse a company’s performance to keep a healthy financial status and avoid monetary bottlenecks. You get to know your financial KPIs using the data in your accounting system. Typically, financial KPIs include:

- Profit

- Gross & Net Profit Margin

- Solvency

- Working Capital

- Liquidity Ratio (quick ratio)

- Debt to Equity Ratio

- Net Cash Flow

- Sales Growth

Importance of KPIs?

KPIs play a key role in ascertaining the growth of your business within a specific time.

KPIs are important to:

- track your progress over time

- solve problems and spot opportunities

- make adjustments and stay on track

- analyse patterns over time

- strengthen employee morale

- support and influence business objectives

- foster business growth

Need Help? Get in touch or Signup now at Accounting Firms to connect with the Best Accounting and Tax Experts near you in just 3 minutes – Register now for Free!

How to Work Out KPIs?

You need to follow these basic steps to work out KPIs:

Find out Measurable Areas of Your Business

To work out KPIs, you first need to know the measurable areas of your business. Getting knowledge of the measurable areas will lead you towards success and help you to tackle potential challenges.

A professional can assist you in finding out the key measurable areas of your business based on:

- your industry type

- your business position

- your business goals (both short and long term)

- the size and location of your business

- any other circumstances as per your business

Concentrate on Key Business Areas

Whilst measuring your key performance indicators focus on the key areas that affect your business. If you are measuring the areas that don’t impact your business performance, there’s no point measuring them.

The KPIs that need to be measured in your business depend on multiple factors. Small businesses need fewer KPIs but large businesses need to divide them into multiple departments.

Focus on quality rather than the number of KPIs that you want to set. Setting up too many KPIs can be difficult to handle. However, you need to keep them enough to get a clear picture of your business.

Analyse the Metrics to Improve

Though KPIs measures your business performance, but you don’t need to rely on them blindly. Consider different factors and make the decision based on them. Like a sales decline may occur due to seasonal variation.

So it is crucial to analyse the KPIs properly before making a decision or resolving an issue. Along with the KPIs result, you also need to use your common sense. It is better to take professional help in this regard.

What is Smart KPI?

SMART is an effective KPI model to set key results. It stands for:

- S– Specific

- M– Measurable

- A– Achievable

- R– Relevant

- T– Time-bound

By implementing the SMART framework, you can better improve your business performance and achieve your business goals.

Quick Sum Up

When it comes to key performance indicators (KPIs), you need to know that you can only get success by tracking fewer KPIs to implement a strategy that best suits your business objective. Sometimes a single KPI can land your business success. So choose your KPIs wisely and work on them to get long-term success.

Sounds complicated! Get help from our financial experts and consultants at Accounting Firms. Register now for Free to connect with the professional. Contact now!

Disclaimer: This blog is written for your basic understanding on KPIs.