If you’re a business owner in the UK, you need to process payroll for your employees. Though it looks straightforward, but the legalities and requirements that come along with payroll make it difficult to process. Therefore, you need to know what is payroll, what is payroll process and how to do payroll yourself.

Let’s kick off with what is payroll?

What is a Payroll?

In simple words, payroll is a list of all your employees and the amount of money they earn. In a broader sense, it is the process of managing the employees’ salaries, wages, allowances, benefits and deductions like Taxes and National Insurance.

What is a Payroll Process?

The payroll process encompasses all the steps involved in paying your workforce. It starts from gathering the information of your employees to sending their paychecks. This process can be done manually or using payroll software. This process involves:

- Working out employees’ wages

- Tracking employees’ working hours/days

- Withholding taxes and so on

To keep your business on the right track by ensuring compliance, you need to take professional assistance from our payroll accountant at Accounting Firms. Set up your free account today in under three minutes!

No matter, you are processing the payroll yourself or taking professional help; you need to understand the steps involved to pay your employees accurately and on time.

Before doing the payroll, you need to make sure that you have gathered information like:

- Employees’ information

- Tax/allowances rates

- UTR (Unique Taxpayer Reference) number

Read on to find out how to do payroll yourself by following these simple steps:

How to Do Payroll Yourself?

Here you might ask that can I do payroll myself? Will I commit errors? How much time I might take to do it? You can do it manually or by using the software. Payroll processing and its complications vary based on your business type, size and nature.

Note that in the UK, payroll tax works through Pay As You Earn (PAYE) system. So, during the payroll processing, as an employer, you need to calculate how much tax your employees need to pay, deduct it from their pay and then send it to HMRC.

This process will the repeated whenever you pay your employees. Whether you pay monthly or paid hourly, the process will remain the same. Therefore, you need to maintain proper accounts, need to do deductions and send it to HMRC by 19 (by post) and by 22 (if you pay online).

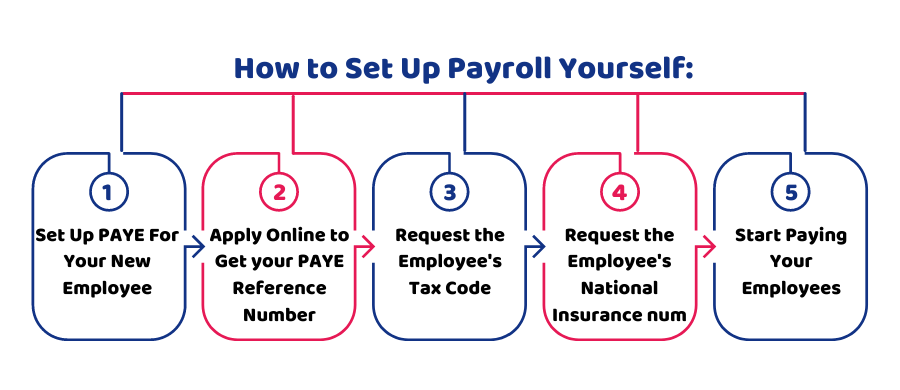

Remember that you first need to set up payroll when you hire your first employee. Here are the simple steps to follow:

1- Set Up PAYE For Your New Employee

After registering as an employer with HMRC, the first step is to set up to pay a new employee and calculate PAYE for them. Then, HMRC will send you the PAYE Reference and the PAYE Accounts Reference. These are required to file the payroll data to HMRC.

Whenever you pay your employees, you need to keep track of it, work out deductions and employer’s National Insurance Contribution, create payslips and report them to HMRC on a document known as ‘Full Payment Submission’ (FPS).

If it sounds complicated, you can take help from our payroll accountant at Accounting Firms. Register now for Free to connect with the professional. Contact now!

2- Apply Online to Get your PAYE Reference Number

After setting up the payroll, HMRC will contact you within 5 working days with your PAYE Reference Number.

3- Request the Employee’s Tax Code

You can get the employee’s tax code on:

- Payslip

- Form P60 or P45

- Letter pensions

4- Request the Employee’s National Insurance Number

Alike employee’s tax code, you need to request their Employee’s National Insurance Number and it can be found on:

- Payslip

- Form P60

- Letters about tax, pensions & benefits

Now you can pay your new employee via PAYE and do all deductions and report them to HMRC on FPS after getting all the required details.

Quick Sum Up

To sum up the discussion, we hope that now you have got a better understanding of what is payroll, the payroll process and how to do payroll yourself in the UK. If you’re still unable to process your payroll, you can outsource it or take help from a professional accountant to do the job properly. Don’t forget the expertise comes with a cost but contains quality, accuracy and efficacy.

If you’re looking for a cost-effective, reliable and experienced payroll expert, then look no further than Accounting Firms to set up and manage your payroll from scratch. Register now for free to connect with the best payroll experts at Accounting Firms.

Have a Query? Feel free to get in touch!

Disclaimer: This blog provides general information on doing payroll yourself.