A cash flow statement lets you know about the cash that is coming in and going out of your business. It is one of the most important financial documents, along with a balance sheet and income statement, to manage finances and to secure your business’s future.

Before going into the details, first, we should know what is statement of cash flow, and why do you need a statement of cash flow.

Let’s start with a brief overview.

What is Cash Flow Statement?

It is a financial document that lets you know how much cash you have right now in a certain period. It tells how the company manages its cash position. It ensures that how well your business generates income to pay its dues and operational expenses. It is a complementary document along with a balance sheet and income statement.

Fulfil your accounting needs with Accounting Firms!

Wondering why you need it.

Why Cash Flow Statement is Needed?

In accrual accounting. There are three reasons for which it is needed:

1) For Showing Liquidity:

It implies that how much operational cash your business holds to meet the expenses. It will help you to assist what you can buy and what you can’t.

2) For Showing Changes in Assets, Liabilities and Equity:

It shows the cash that goes out of your business, cash inflows, and the cash that has been held. These categories are the core of your business accounting. When they are added together, they form the accounting equation to measure your business performance.

3) For Cash Flow Forecasting:

It is needed for forecasting your cash flow liquidation for the future. It will help you to know how much money you’ll be having in the future to operate your business. It will also help you to make long term business decisions.

Key Takeaway: If you’re looking for a loan or credit, you need to have an up to date statement of cash flow.

Get an accurate cash flow statement with accounting firms!

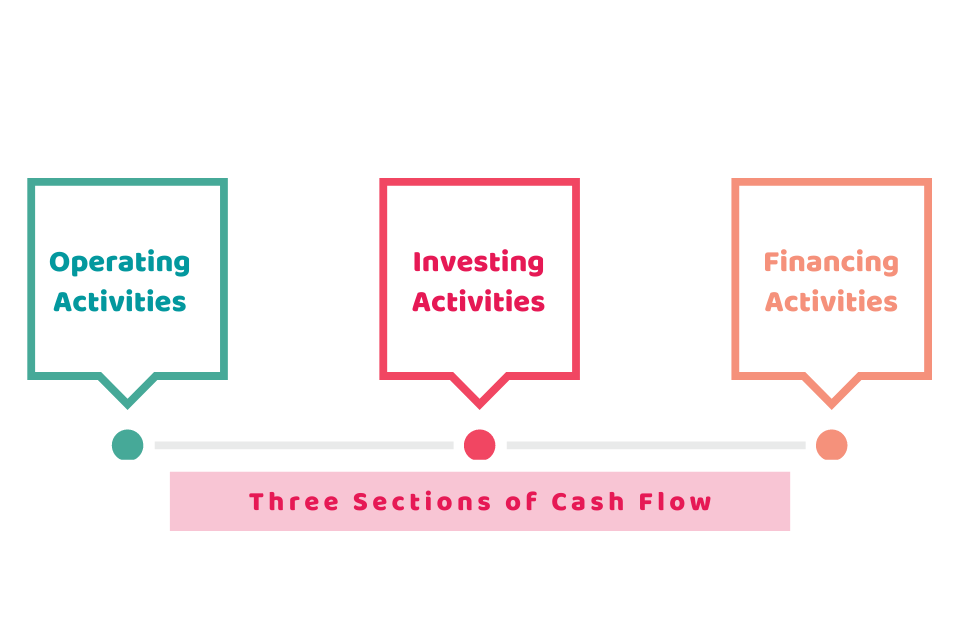

Three Sections of Cash Flow:

These sections of cash flows show how the money comes into your business and how it goes out from it.

- Operating Activities: Cash earned or spend through regular business activity other than investing or financing.

- Investing Activities: Cash that is spent or earned from the investment of the company, like purchasing equipment and long-term assets.

- Financing Activities: It includes the earnings or spendings on credit, owner’s equity, and loans.

Quick Sum Up:

The cash flow statement, along with the balance sheet and income statement, can be a great tool to boost the financial health of your business. It will show the financial well-being of your company that is used for attracting investors and obtaining loans.

Feel free to contact our accountants for further help.

Disclaimer: This blog provides a general overview of the statement of cash flow.