Public liability insurance (also called PL insurance) is one of the main types of business insurance that covers businesses of all sizes, types across multiple industries. It covers you for the legal and compensation cost if a public member (supplier, customer or passerby) make a claim against your business. Read on to learn: what is public liability insurance, who needs it, what cover it provides, and how much cover do you need. Let’s get started!

Whether you need help from an accountant/tax expert OR want to showcase your services as an accountant, tax expert, bookkeeper, and business advisor. There’s no better place to market your online shop than Accounting Firms!

What is Public Liability Insurance?

PL insurance covers your business against the compensation claims and legal costs made by the third party due to an injury or damage caused by you or any of your business activity. So this insurance protects business owners and their assets against claims that result in legal proceedings.

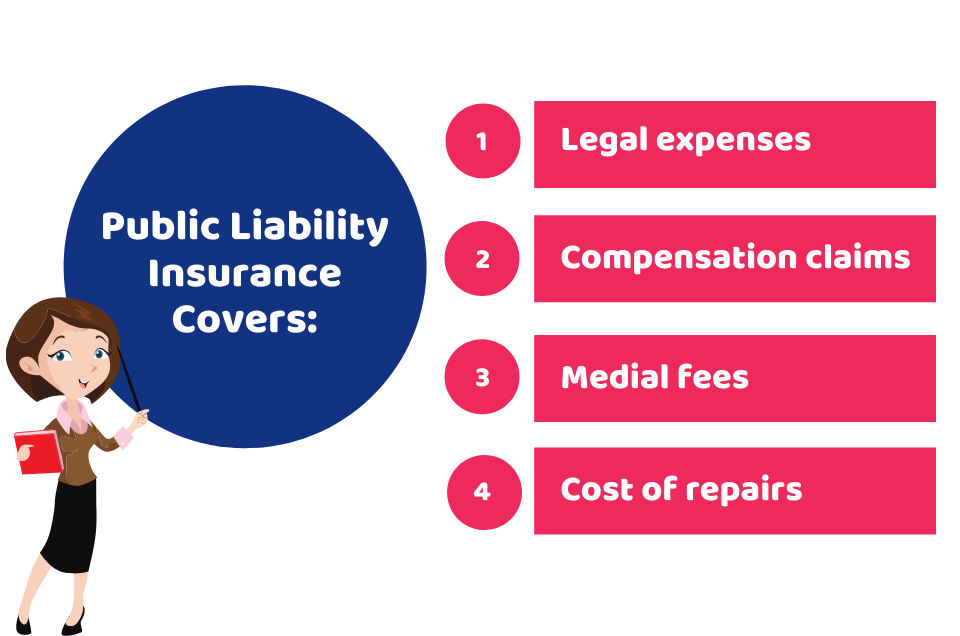

What Does Public Liability Insurance Cover?

Typically, this insurance offers an extra cover for your business, including:

- Legal expenses

- Compensation claims

- Medial fees

- Cost of repairs

Bear in mind that this insurance doesn’t cover up any damage, injury to yourself or your employees. In addition, if there are legal proceedings by any of your employees, this insurance doesn’t protect you from it. Rather, you need to have employer’s liability insurance.

Are you an Accountant or Accounting Firm looking for potential clients? Set up your online account at Accounting Firms to get quality leads and sales like never before. Register now in under three minutes to get started!

Who Needs PI Insurance?

You are legally bound to have this insurance, however, if you operate a business, you’d most probably need it. This insurance is needed to cover the legal and compensation cost if someone sues your business. Not having this insurance can take your business to the verge of bankruptcy due to the legal costs involved.

This insurance is more important for those businesses that deal with the public on daily basis. Whether you have a grocery store, cafe or a store, you can be on the safe side if customers face an accident, they may sue you for that. This insurance ensures that you are saved to pay the bill.

Sometimes you need this insurance even if you don’t have a physical office. A customer can bring you to court due to your business activity, even if you are working from home. Additionally, sometimes your clients might require you to have this insurance before they work with you.

How Much Cover Do I Need?

It depends on many factors and your circumstances. As not every business is the same. So not every business is going to have the same level of risk. For this reason, you need to consider how much risk your business face and you also need to ask your clients whether they need you to have a cover.

Remember that if you have lower risks, you need a low level of cover. On the other hand, you have more interaction with the public and there are more chances of being sued, you need to have a larger cover for your business.

Many of the insurers offer a cover starting from £1 to £1o million. In addition, you also need to consider the business type and industry you operate. As a general rule, bigger businesses need more cover and smaller ones need small cover.

Quick Sum Up

So after giving this post read, you have learned: what is public liability insurance, what does it cover, who needs it, and how much cover do you need? It covers you for third party injury or damage claims. You need to consider different factors before getting this insurance, like your business type, its size and most importantly the level of risk it has. You can search online to compare quotes and options to find the best cover.

Get help from our cost-effective, reliable and experienced professionals at Accounting Firms to provide you with the best advice on PI Insurance as per your circumstances. Register now for free to connect in under three minutes!

Have a Query? Feel free to get in touch!

Disclaimer: This blog provides a basic overview of PI Insurance.