Whether you’re putting aside some money for an emergency, purchase of a house/property or saving for your retirement, you need to pay tax on the amount of interest you earn from your savings. Although interest is taxable in the UK, but there are different allowances available to benefit from. However, there are also some pitfalls that you need to be aware of. So in this blog, you will learn: what is saving interest, what is the starting rate for savings, what allowances are available and how to pay tax on savings.

Let’s dive in!

Accounting Firms is the UK’s only instant Accountancy & Taxation Fee Comparison Website, where you can search, compare profiles, and reviews of accountants and tax experts. Register today to get in touch with them!

What is Saving Interest?

Saving interest is the amount earned on the money you save in an account. The interest you earn on your holdings is set by the rate provided by your savings account.

For example, if you hold £5,000 into your saving account for a year with a 2% fixed rate of interest. The amount of interest you will earn on your holdings will be £100 in a year (2% of £5,000 = £100).

There are three main types of interest:

- Annual Interest

- Compound Interest

- Monthly Interest

The interest you earn is taxable in the UK, but you don’t need to pay it if you qualify for a starting rate for savings and personal saving allowance. Read on to explore more about them.

Starting Rate for Savings

If you are earning a small amount of interest (up to £5,000) from your saving account, you don’t need to pay tax on it. Currently, in 2021/22, the starting rate of saving is tax-free up to £5,000.

However, you do not qualify for a starting rate for savings if your other (standard) income is £17,570 or over. Remember that the more you earn from non-interest income (like pensions or wages), the less your starting rate of savings will be.

Every £1 of other income (like wages) above your Personal Allowance (£12,570) will decrease your starting rate for savings by £1.

Suppose your standard wage is £15,000 and you receive £300 interest on your savings (with a Personal Allowance of £12,570). Your basic PA will be used by the first £12,570 of your wages. The remaining £2,430 of your wages (£15,000 minus £12,570) will reduce your starting rate for savings by £2,430.

In this case, your remaining starting rate for savings will be £2,570 (£5,000 minus £2,430). This implies that £2,570 can be earned in interest from savings tax-free, so the £300 of interest earned from savings is exempted from tax.

Want to know more about allowances? Keep reading!

Worried about Taxes? Get help from our Qualified Accountants, Bookkeepers, Tax Experts at Accounting Firms!

Personal Saving Allowance (PSA)

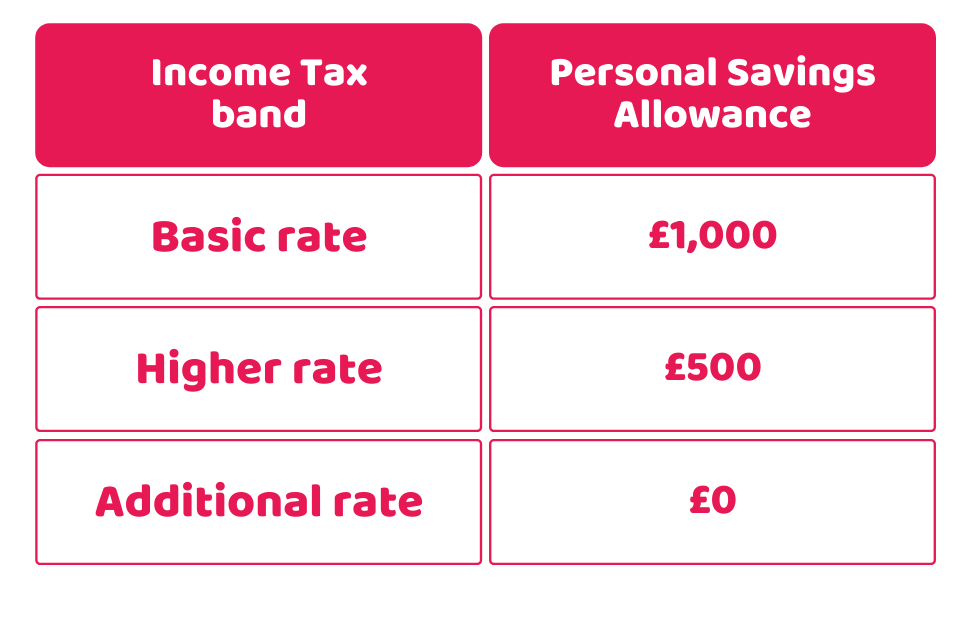

Along with the starting rate of savings, you can also benefit from Personal Saving Allowance (PSA). Alike the former, you can earn tax-free interest from your savings with PSA. It will be based on the income tax rate band, where your income falls under.

Personal Saving Allowance varies based on the Income Tax Band you fall in. Here is the table that shows your PSA based on your income tax rate band:

Personal Allowance (PA)

Personal Allowance allows you to earn a certain amount each tax year before paying tax on your income, including your savings interest. Currently (2021/22) your Personal Allowance is £12,570, which is tax-free.

This allowance can rise if you claim Blind Person’s Allowance/ Marriage Allowance. However, it will drop if your income is over £100,000.

How to Pay Tax on Savings?

Once you have used all your allowances to earn tax-free interest, but still if there is any remaining amount, you need to pay tax on it. The process of paying tax on savings interest is similar to the usual rate of income tax. HMRC will automatically charge you by changing your tax code if you’re employed or receive a pension.

To decide your tax code, HMRC estimates your current year’s interest with that of the previous year. Whilst completing the Self Assessment Tax Return, you need to report any interest that you earn on savings.

If your income earned from savings and investments is more than £10,000, you need to register for Self Assessment.

However, if you’re not employed and do not get pensions, you are not required to complete a Self Assessment. In such a case, your building society or bank will inform HMRC about the interest you earned on a year-end. Then, HMRC will inform you if you need to pay tax and how will you pay it.

Quick Sum Up

We hope that after reading this post, you have got information on what is saving interest, what are the different allowances available on interests, and how to pay tax on savings interest. Remember that the tax payment process on interest works the same as that of income tax.

For employed or pensioners, HMRC will automatically charge the tax by changing the tax code. However, you still need to report it in your Self Assessment Tax Return if you are employed or pensioner. In other cases, your bank and building society will let HRMC know about the interest you earned in a tax year.

Searching for a Tax expert to reduce your Tax Burden. Signup now at Accounting Firms to connect with the Best Tax Experts near you in just 3 minutes. We are a one-stop-shop for all your business problems!

Have a query? Get in touch for instant help!

Disclaimer: This blog is written for your general information on the process of paying tax on savings interest.