Before embarking on a business venture, you first need to choose the business structure that suits your circumstances. Broadly, there are three types of business structures: sole proprietorship, partnership and limited company. Sole proprietorship suits professionals who work individually, while the partnership is a business with at least two partners. And a limited company is a business entity that has a legal identity on its own. Ltd has a bigger scope and legal obligations than both. In this blog, we will be discussing what is a partnership and what are its advantages and disadvantages? Let’s have a look!

Whether you need help from an accountant/tax expert OR want to showcase your services as an accountant, tax expert, bookkeeper, and business advisor. There’s no better place to market your online shop than Accounting Firms. Register now!

What is Partnership?

Section 1 of the Partnership Act 1890 defines it as “Partnership is the relation which subsists between persons carrying on a business in common with a view of profit”. So, it is a formal arrangement (with a partnership deed) by at least two or more parties who wish to start and operate a business together. It is not considered a separate legal entity and there is less paperwork involved in forming a partnership business.

The profit and liabilities are shared equally in a partnership. This business structure is more tax-efficient than a limited company. There are three types of partnership:

- Ordinary partnership

- Limited liability partnership

- Limited partnership

How Partnership Works?

In a general partnership, partners share all the legal and financial liabilities equally. Partners are personally responsible for the debts taken by the ordinary partnership business. In an LLP (limited liability partnership) the personal liability of the partners is protected. It means that in case one partner faces a prosecution, the other partner will not be liable for it, thus the assets of other partners are safe.

And limited partnership is the mix of both ordinary partnership and limited liability partnership (LLP). Here, one partner is active, who is responsible for the partnership’s debts. The silent partner’s liability is limited to the amount invested and he/she does not participate in management or day to day operations.

Skyrocket your business revenue with our professional accountants, bookkeepers, tax experts and business consultants at Accounting Firms! Register today in under three minutes – For Free!

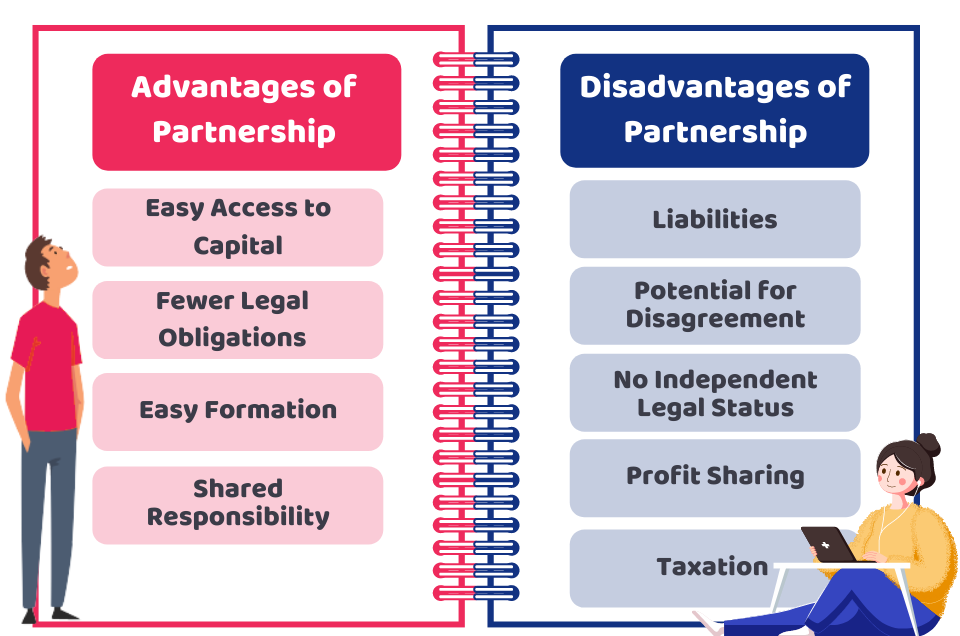

Advantages of Partnership

Before starting a partnership, you need to do a deep analysis of the pros and cons of the partnership to make the final decision. Here are some of the advantages of operating a partnership:

1) Easy Access to Capital

To start the business, the partners will contribute to the start-up capital. So the more partners a business has, the more money will be invested in the business. This will lead to more flexibility and profit that will ultimately grow the business.

2) Fewer Legal Obligations

Partnership business has fewer legal responsibilities and formalities compared to a limited company. Be it registration, accounting, taxation and dissolution, everything can be managed with less hassle.

3) Easy Formation

A partnership business can be easily formed by verbal or written consent. It doesn’t need registration with Companies House. The registration of partners for self-assessment is a straightforward process.

4) Shared Responsibility

The partners share the responsibility of running a business. They can split different tasks to share the workload to operate the business efficiently.

Disadvantages of Partnership

Here are some major disadvantages of partnership that you should be aware of:

1) Liabilities

Along with sharing profits and assets, the ordinary partnership also shares losses and liabilities, even if they are incurred by any of the partners. Due to the unlimited liability, it can place a burden on the personal finances of a partner.

2) Potential for Disagreement

One of the great disadvantages of the partnership business is the possibility of disagreement. With the disagreement, it can harm the business along with the relationship between the partners. Therefore it is recommended to draft a partnership deed during the formation process.

3) No Independent Legal Status

The partnership has no independent legal status. Without a partnership agreement, it can easily be dissolved upon the resignation or death of a partner. This will lead to insecurity and instability in a business that can be a great hurdle for business development.

4) Profit Sharing

Profits, in most instances, are shared equally among partners that can lead to inconsistency. As one partner will do more work and toil than the other, but will still get the same reward.

5) Taxation

Tax laws work the same for a partnership as a sole trader. The partners need to register for self-assessment and complete a tax return each year. They need to register as self-employed with HMRC. Additionally, partners are taxed at a higher level than that of a limited company.

Quick Sum Up

So you have now got a better understanding of what is a partnership? How does it work? And what are the advantages and disadvantages of a partnership? We may conclude that the advantages of partnerships overweight its disadvantages. And most of its disadvantages can be tackled with due diligence and partnership agreement. So before setting up a partnership, you need to consider all the mentioned pros and cons.

Get help from our cost-effective, reliable and experienced professionals at Accounting Firms to sort out your financial woes. Register now for free to connect in under three minutes!

Have a Query? Feel free to get in touch!

Disclaimer: This blog provides a basic overview about partnership.