Do you know what is turnover and how to work out your Business Turnover? In this article, you will be able to understand the notion of business turnover and how you can calculate it.

We will provide you with all the information about business turnover and help you to understand how it is one of a trademark to know your company’s position. Contact us today!

What is Turnover?

Turnover is the total money acquired by a business as a result of sales of your goods and services over a specific period.

Why is Business Turnover important?

As turnover is the net sales generated by a company before the deduction of any cost. Therefore, turnover is very important to reduce the percentage of expenses and better the earnings and profits. Moreover, it helps in improving the company’s valuation and gaining a healthy profit.

How is Turnover Different from Profit?

Turnover is generated by a company before the deduction of any cost. In turnover, we do not deduct the expenses. Whereas, Profit is the earning of a business after all the expenses are deducted against the specific turnover (net sales). Following are the two terms for calculating profit.

- Gross profits

- Net profits

How is Turnover Calculated?

Calculating the turnover of a company is quite simple if you have recorded all the sales accurately. Then it would be relatively quick to add together all of your total sales. Turnover is calculated for a certain period.

To workout turnover you should know the following terms:

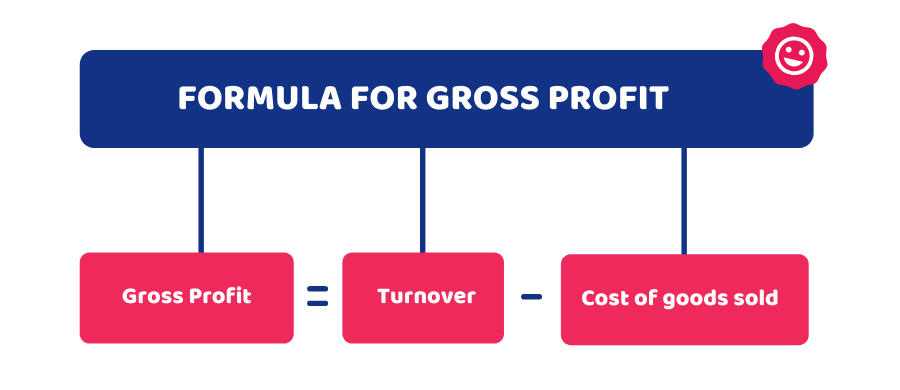

- Gross profit: to deduct the cost of the sales from the turnover.

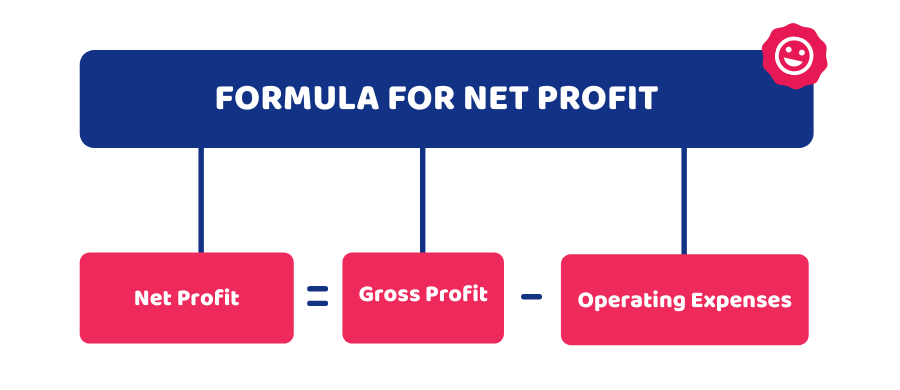

- Net profit: takes the gross profit and deducts all the other expenses.

Reach out to our Chartered Accountants to get your business turnover calculated!

Example to Calculate Business Turnover

Suppose you have a turnover of £60,000. You will need to deduct all the sales from the turnover to get the Gross profit. From the resulting Gross profit, you will deduct all the operating expenses. As a result, you will get the net profit of a business.

Gross Profit = Turnover – Cost of goods sold

Gross Profit = £60,000 – £10000

Gross Profit = £50,000

Net Profit = Gross profits – Operating Expenses

Net Profit = £50,000 – £20000

Net Profit = £30,000

If your Gross profit is less than your turnover, you may want to find a possible solution to reduce the cost of your sales. And if your net profit is lower than your turnover, you may need to know the feasible strategies to make your business more profitable.

Conclusion

Understanding what is turnover and how it can help you in knowing your company’s financial position will help you a lot in growing profit. If you know the turnover of this year and after calculating the profit, you will be able to compare your current profit with the previous one. This will help you to know whether your business is growing, and it matches the required target or not.

Get help from our Qualified Accountants, Bookkeepers, Tax Experts. Compare their Services & Fee, and Signup now in 3 minutes at Accounting Firms!

Disclaimer: This blog is written for general information on business turnover.