In this blog, we will tell you what is a UTR number.

To uniquely identify yourself and your business, you need a 10-digit number code called a unique tax reference number. While dealing with your tax, these 10-digit codes are used by HM Revenue & Customs. Let’s explore what is a UTR number.

A UTR number uniquely identifies a person and his business. Therefore, it is used to ensure that the tax collector knows the person he is talking to throughout the tax filing procedure.

If you want to know more about unique tax reference numbers, what is a UTR number, why you need this number, and where and how to find it, you just have found the right post. This article will provide all the basic and necessary information about a UTR number. So let’s start!

Save yourself the trouble and let the experts handle your taxes. For the most affordable tax services in the area, turn to Accounting firms!

Why is a UTR Number Important?

A UTR number is a 10-digit code used to uniquely identify a person and his business. Therefore, there are a few common circumstances where you will need a UTR number. These are as follows:

- Filling a Self Assessment tax return

- Working with the accountant (who manages your finances)

- Signing up for CIS (Construction Industry Scheme)

Where can you Find your UTR Number?

The documents and the previous tax returns provided by HM Revenue & Customs will contain your UTR number. For instance,

- The notices you get to file a return

- The payment reminders you get

These documents and tax returns will include your UTR number. Moreover, if and only if you are registered for Self Assessment, you can also find your UTR number in your Tax Account as well.

You Can’t Find the UTR Number?

If you cannot find the UTR number from the previous tax returns and documents provided by the HMRC, you can call the Self Assessment helpline, and you can request your UTR there. However, if you are running your own company, then you can request the number online. HM Revenue & Customs will send your UTR to the registered business address.

How to Find Your Lost UTR Number?

A UTR number is instinctively sent to a person when the specific person is;

Registered for Self-assessment or when he structures an enterprise.

This 10-digit code number may also be called a “tax reference.”

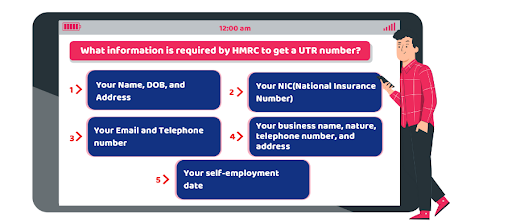

What Information Will You Require to Get a UTR Number?

The information required by HMRC to get a UTR number is as follows:

- Your Name, DOB, and Address

- Your NIC (National Insurance Number)

- Your Email and Telephone number

- Your business name, nature, telephone number, and address

- Your self-employment date

Conclusion

We hope that all the related information regarding a unique tax reference number, i.e., what is a UTR number, from where, and how you can find a UTR number, is clear to you. Therefore, we would sum up our conversation by saying that the UTR number is important as it uniquely identifies you and your business. Moreover, this 10-digit code is also used to identify unauthorised users (frauds and thefts). So, it’s very important to monitor your UTR number.

AccountingFirms is the UK’s only instant accounting and taxation fee comparison website. Register Today!