Often the companies that are working in the field of Science and Technology for some Innovative Projects are Offered Research and Development Reliefs Support.

Research and Development Costs can be claimed by a single company or multiple companies that are working for research and development to upgrade their fields. Even if your project is not successful, the claim will be considered.

The only condition that you have is that your project should meet the standards of the definition of Research and Development.

Learn how it is advantageous for your business to claim for R&D Tax with Accounting Firms!

What Is Research And Development Cost?

When a new search is planned in order to upgrade the current processes and knowledge for offered products by the companies, and the cost incurred in such projects is defined as Research and Development Costs.

Before you decide to claim for the cost spent on such projects, you need to first gather information about the standards to meet the criteria of R&D Projects. Following is the description of what exactly counts as R&D Projects?

R&D Projects:

Projects that are designed to make an advance in Science and Technology and the project your company works on must qualify for R&D Standards. The advance should not be planned for the field like social sciences, economics or other theoretical fields like Maths.

The other components to consider is that the project must relate to the type of business that your existing company carries or intends to carry in the future.

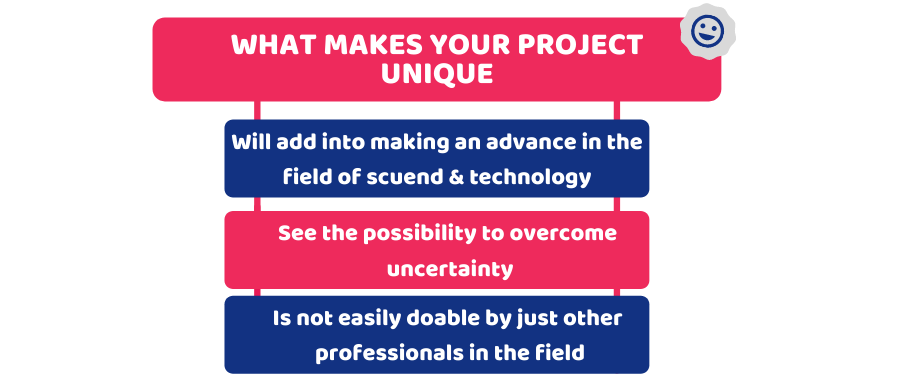

Moreover, to get the benefits of Research and Development Reliefs you need to give justifiable reasons as to how your project:

- Will add into making an advance in the field of Science and Technology.

- See the possibility to overcome uncertainty.

- Is not easily doable by just any other professionals in the field.

The project that your company intends to work on can develop a new service, product or a process to make an advance in the relevant field.

Do Reach Out to Our Professionals for a better accounting treatment for Research and Development Costs!

Make An Advance In The Overall Field – Project’s Aim:

The project on which the planned research is being done must aim to make an advance in the overall field and not just a limited upgrade for your business. In other words, the advance does not mean to use a specific technology that is already existing to upgrade your business only.

The innovative product, process or service that you are trying to make should not be familiar to other professionals. It will be accepted as an advance even if it is developed by any other company but it is not publicly known as yet.

Prove that It Is not easily doable by just any other professionals in the field:

A mind convincing reason that must depict why your innovative service, product or process is not easily doable by just any other professional in the field. You can prove by adding some attempts made by other professionals that failed earlier. Also, the professionals working on your projects are only related to you to make your service offers unique in the market.

See the possibility to overcome uncertainty:

The uncertainty in the projects refers to the inability to develop something of the same sort by available evidence. This means that you ensure that even if the professionals reach their hands to the available evidence, there will be uncertainty if they could invent the same service or process for their company.

The Process Will add to making an advance in the field of Science and technology:

The services, processes or products offered by your project must make an advance in the overall field and not just in your business. This must relate to something that is not familiar to people. Even if another company is working on the same project and it is not publicly known, your project will be considered for Research and development cost relief.

Different Types Of Research And Development Reliefs:

The suitable type of Research and Development cost Relief depends on the size of your company and the project you aim to develop is related to your company’s trade or not.

SME – R&D Relief: You can claim for for SME R&D Relief if you meet the following listed standards:

- Staff members under the figure 500

- Your turnover is under 100 million euros

SME – R&D Relief will allow your company to:

- Deduct 130 percent of the qualifying cost from your yearly profits.

- Claim for the tax credits if the company is making loss upto 14.5 percent of surrenderable loss.

Large Company Schemes: in case of a large company scheme, you can claim for Research and development expenditures due to making an advance through your project.

Conclusion:

To sum up the discussion, we can say that Research and Development Cost Relief is advantageous to build on your business value and your business name will gain the limelight by making an advance in your field.

To know more about the benefits of Research and Development Expenditure credits for your company, talk to our Experts!