The basics of accounting are essential to understand for business owners to run a business successfully. So, a business owner must focus on the three financial statements: balance sheets, profit and loss statement (P&L), and cash flow statements.

In this blog, we will inform you about the P&L statement and how to prepare it.

Accounting firms is the UK’s only instant Accountancy & Taxation Fee Comparison Website. Whether you’re an accountant or accounting firm or someone looking for accounting services. Register today to get what you’re looking for!

What is a Profit and Loss Statement (P&L)?

A P&L statement provides a comprehensive overview of a company’s income and expenses during a given timeframe.

It informs you about the current position of your company, whether it is making a profit or loss. SMEs owners can utilise this financial statement to assess the company’s performance and develop new strategies for improvement.

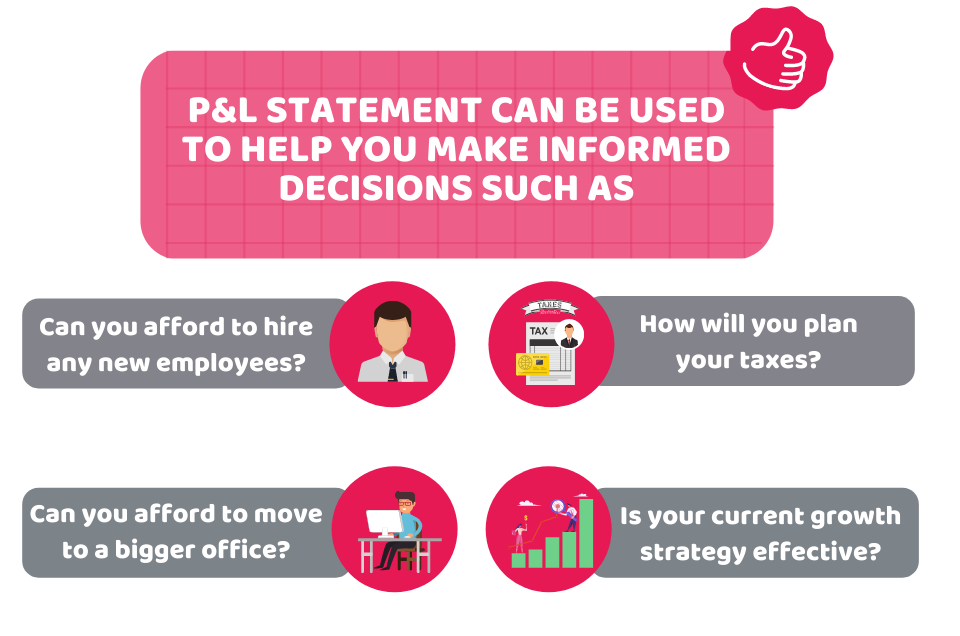

The main objective of a P&L statement is to work out the total operating profit or loss of a company. It assists you in making the following decisions:

How to Prepare a Profit and Loss Statement?

Many SMEs use spreadsheets to maintain a simple log of their revenue and expenses. At the end of the tax year, they give it to their accountant to turn it into a professionally formatted P&L statement. This is then ready to be submitted to HM Revenue & Customs. However, there are SMEs that don’t have any accountants.

So following are the steps that you need to follow in order to perform a majority of work by yourself.

Let our qualified accountants measure your business profit. Contact us today!

Steps to Prepare your Profit and Loss Statement

You can not perform all the calculations by yourself, as some appear to be simple, but they require professional help. However, if you do more work, then your accountant will take less time to finish off. The steps you need to follow are as follows:

- Create a top row for total sales if you are running a trading business or total income if you are running a service business. Create it by utilising your financial management software or a spreadsheet.

- Every column should show a different month, generally beginning from the start of your tax year or from the month in which your company incorporated.

- Some rows below create another row for other business revenue. This can include other revenue like, interests on business investments or savings.

- For “total turnover”, create a third row. It contains the sum of the first two rows (total income, total sales, and other business revenue are added together).

- Insert another row named COGs (cost of goods sold), which includes the total expenses or cost of stock of that month.

- Now add a row for the total cost of sales. In it, you will put the total of your stock purchases or your expenses.

- And, finally, add a row underneath titled “gross profit”. It will contain your total turnover – total cost of sales.

- To give details information about your expenses in different categories, insert a series of rows below it. These categories will contain staff costs, travel costs, marketing & advertising expenses, utilities, insurance, and rental costs, bank and other financial charges, professional fees, depreciation on business assets, office costs, irrecoverable liabilities written off, and other business costs.

- Add all of these expenses, and then deduct this figure from your gross profit or loss. By following these steps, you will get your net profit or loss figure for the accounting period.

Final Thoughts

We hope now you can prepare your profit and loss statement with the help of the steps mentioned above. We will conclude our blog by saying that as you can perform this calculation by yourself, this does not mean you don’t need a help of a professional. There are some calculations that can not be performed without the help of an accountant. If you don’t have an accountant yet, please choose one to manage your business finances effectively.

Get help from our Qualified Accountants, Bookkeepers, Tax Experts. Compare their Services & Fee, and Signup now in 3 minutes at Accounting Firms!

Disclaimer: This blog contains general information about P&L statement.