When it comes to paychecks, you need to know what is gross pay. The gross pay is the advertised amount used by the companies to attract people to jobs. However, it’s not the amount that is provided to the employees. By knowing the gross pay and how it works can help you to make better business decisions to know whether a job offer meets your salary needs or not.

What is Gross Pay?

Gross pay is the total pay an employee gets before taking out taxes and other deductions like insurance, medicare, social security, retirements, etc.

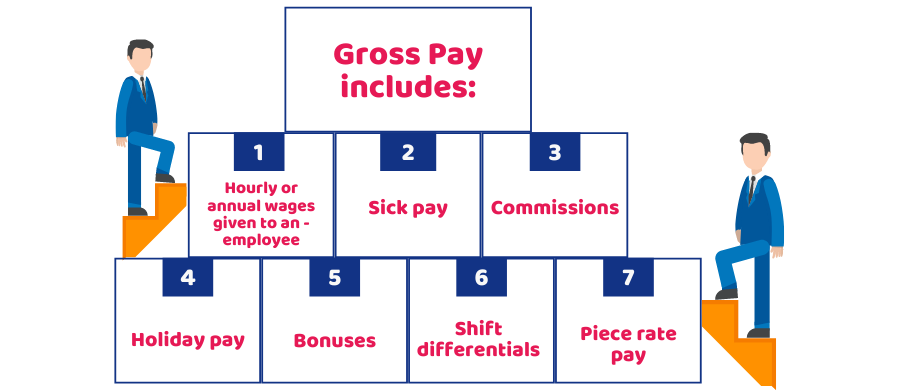

It includes:

- Hourly or annual wages given to an employee

- Sick pay

- Commissions

- Holiday pay

- Bonuses

- Shift differentials

- Piece rate pay

How to Calculate Gross Pay?

You can calculate the hourly gross pay by multiplying the number of hours worked in a pay period multiply by the hourly pay rate. It includes waiting time, on-call time, meal breaks, etc. In addition, the gross pay of a salaried employee is calculated by dividing the total annual amount by the number of periods an employee receives the pay.

Save yourself from the trouble and let the experts handle your payroll and its taxes. For the most affordable payroll services in the area, turn to Accounting firms!

How does it work?

Let’s say if a person gets £10 per hour and provided his services for 43 hours with overtime pay of £15 for all hours above 40. You’d do the following steps:

- Calculate regular pay (£10 x 40 hours= £400)

- Work out the overtime pay (£15 x 3= £45)

- Add them

Here the gross pay of an employee would be £445 (£400 + £45). If you’re a salaried employee with an annual earning of £60,000, divide this amount by 12 (pay periods) the answer would be £5000. This amount is the gross pay of a single pay period.

When Gross Pay is needed?

You need to determine employees’ gross pay to work out taxes and other deductions. These deductions taken out from the employees’ pay are based on the gross pay.

Firstly, you’d do the pre-tax deductions. You need to make these deductions before subtracting taxes from your gross pay. These deductions might be the fixed amount or percentage of the gross pay.

Then, you’ll deduct employee taxes. You need to deduct these taxes of employees’ gross wages as a percentage or a fixed amount from the pe-tax deductions.

In addition, you’ll also use the gross wages of employees to work the taxes of your employees’ taxes. These taxes are the percentage of the employees’ pay.

At last, you will deduct the post-tax deductions from the gross wages. Similarly, as pre-tax deductions, these deductions can either be a fixed amount or a percentage.

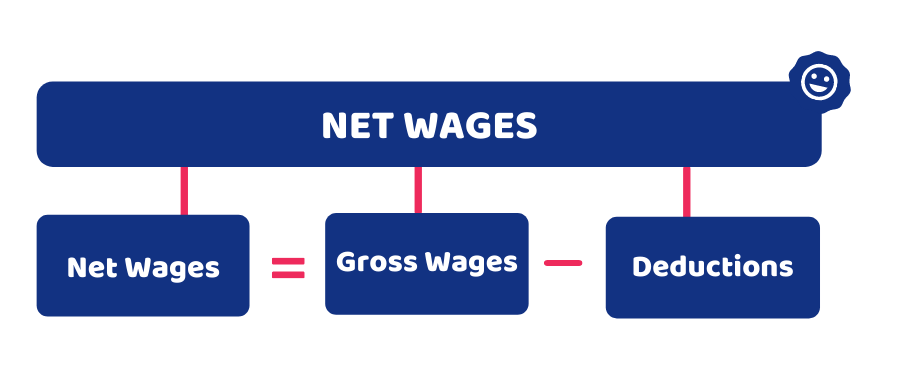

Gross Wages vs Net Wages

As discussed, gross wages are the amount paid to the employees before deductions. Whereas, net wages or pay is the money an employee earns after making all the deductions including taxes. Net wages are the take-home pay of an employee. Calculating the net pay is pretty straightforward, you just need to deduct all taxes and other deductions from the gross wages. Here is the formula:

Net Wages = Gross Wages – Deductions

Quick Sum Up

Knowing what is gross pay and how to calculate is crucial to work out your paycheck and see whether your paycheck is as per the decided salary. In addition, it is also important for employers to avoid errors while working out the payroll. Moreover, remember that the gross pay is not your take-home pay and the net pay is the one you can take home.

If you are stressed out with your payroll? Get the payroll services from our accountant at a reasonable price! Contact us right away for the tailored offer!

Providing the solution for all the accounting businesses. Accounting firms a platform that brought all the accounting businesses together to market/advertise their accounting services/firms at a better rate. Register Today!