Capital equipment is an asset that lasts more than a year and is depreciated after a certain period. You can call it an investment that directly affects the business’s profit. So in this blog, we’ll explore what is capital equipment and what are its types.

What is Capital Equipment?

Capital equipment is an item that generally exists longer than a year and is used for productive purposes in a business. Manufacturing activities and services are carried out using capital equipment. It costs above $5000 and is not attached to the buildings or grounds permanently.

On the contrary, if any items cost less than $5000 and its life is below 1 year, it is considered non-capital equipment.

These items are used while selling, transporting, storing, and delivering goods.

In accounting, they’re known as capital assets which provide operating benefits for the business in a certain period. These items can be bought, leased, or donated. There are some items that fulfill the definition of capital equipment but are not capital equipment. Like software and land, etc.

Our accountants will forecast the results of capital investment. Get in touch now!

After discussing, what is capital equipment, let’s move to its types.

Types of Capital Equipment:

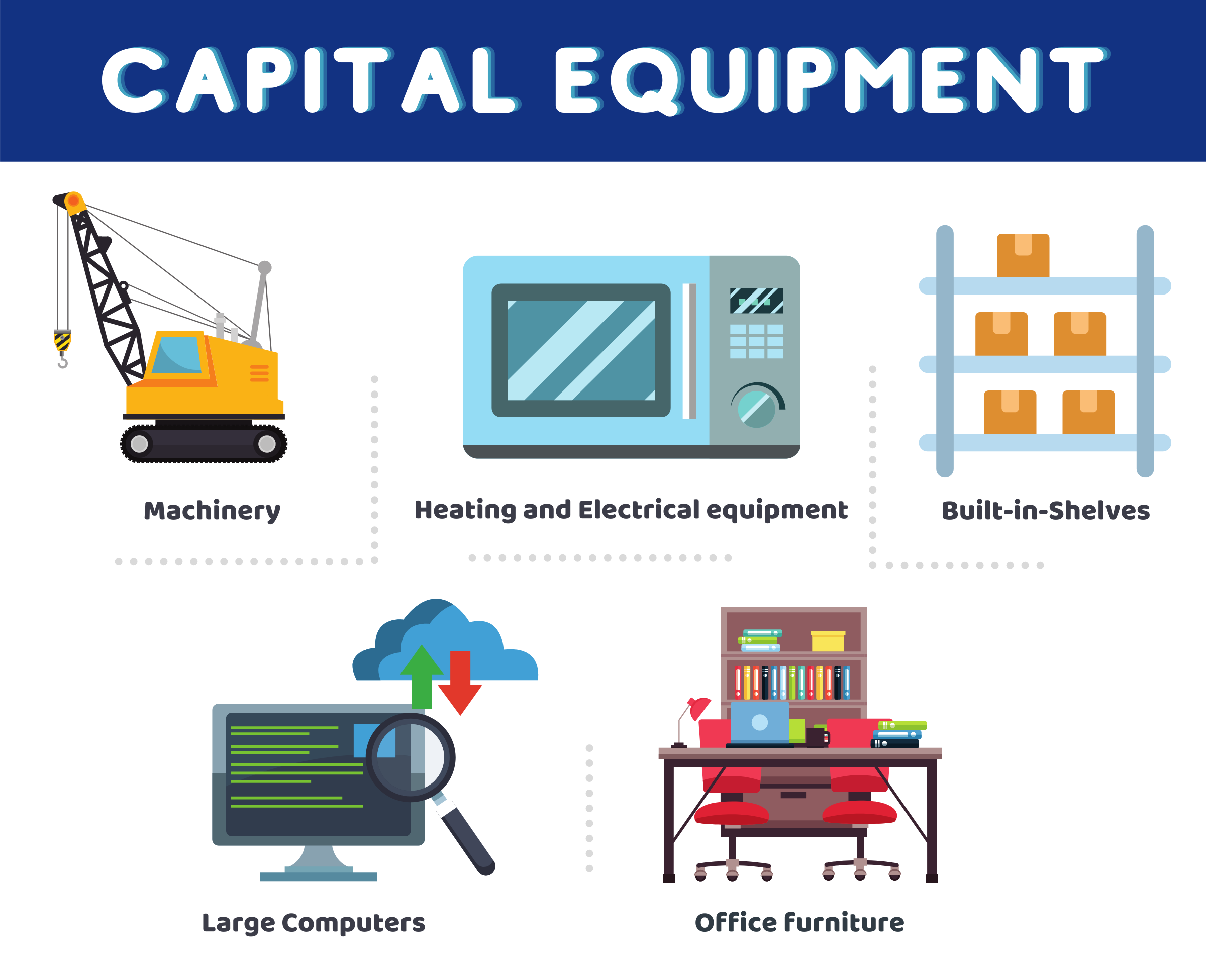

Following are the types of capital equipment:

1. Fixed Capital Equipment(FCE):

This type of capital equipment is attached to the building on a permanent basis. Fixed capital equipment has an estimated life of above two years and costs above $5000. If the FCE is removed from the building, it affects the worth of the building and reduces its value. FCE is not included in inventory records. Examples include plant, electronic equipment, machinery, built-in shelves, and installations.

2. Movable Capital Equipment (MCE):

This capital equipment is not permanently attached or fixed with building, ground, or structure as it is not an integral part of them. Its detachment does not affect the value of the items or property. They are given inventory numbers and recorded in the general inventory file. They are further classified as stationary or portable:

-

Stationary Capital Equipment:

Many household items are used in the same location as per their size and usage. These items are known as stationary. Their locations the permanent part of inventory records.

-

Portable Capital Equipment:

Items that are movable from one place to another due to their size, weight, and application are known as portable equipment. Examples include; test meters, dictating machines and digital devices, etc.

If you’re looking for an expert to provide you in-depth advice on the buying process and financing options of capital equipment, our business accountants are here to provide you a deep insight into the subject. Ask us anytime!

Quick Sum Up:

We are hopeful that you’ve got the answer to what is capital equipment and what are its types. Capital equipment is also called a non-current asset that increases its value and depreciates with time.

Prior to capital investments, you should consider the long-term objectives of your company, the requirement of additional items, and the future advancement of the items. Moreover, you should also think about the buying process of capital equipment whether it is good to buy or lease. The most important point to ponder before buying is that the capital equipment, you are buying, should provide optimal benefit within the minimum payback period.

AccountingFirms can help you to choose the best capital equipment as per your needs to achieve maximum benefit for your business within a short time.

So, don’t hesitate to contact us.

Disclaimer: This informative blog provides a general overview of Capital Equipment and its types.