Many of our clients wonder how to dissolve a company cost-effectively without much hassle, the best way to do this is to dissolve or strike off a company voluntarily. This will remove your company from the register of Companies House. However, there are certain conditions you need to meet to do a voluntary dissolution.

By meeting these conditions, you can put your company into dissolution without any liquidating cost, investigation and without being much noticed in the public. Before we discuss how to dissolve a company, let’s see what are the conditions for company dissolution?

Whether you need help from an accountant/tax expert to dissolve a company OR want to showcase your services as an accountant, tax expert, bookkeeper, and business advisor. There’s no better place to market your online shop than Accounting Firms. Register now!

What are the Conditions for Company Dissolution?

To do a voluntary disclosure (to remove the name from the Companies House Register), you must need to meet certain conditions. These are:

- Being solvent, the company needs to pay off all its liabilities and outstanding debts in full within 12 months

- The company hasn’t changed its name and traded in the last three months

- There are no ongoing legal proceedings against the company

- The company has not sold any rights or property owned by the business in the last three months

- The company does not hold any assets, property or cash at the bank

- Creditors can reject the request to dissolve the company within three months

To learn about the full conditions of company legislation, visit the government website.

When You Cannot Dissolve a Company?

Here are the conditions when you cannot dissolve a company:

- A formal insolvency procedure has started like CVL, CVA, receivership, administration, or compulsory liquidation under the Insolvencies Act 1986, or scheme of arrangement under the Companies Act 1985

- There is a winding-up petition issued against the company

Need help? Reach out Today!

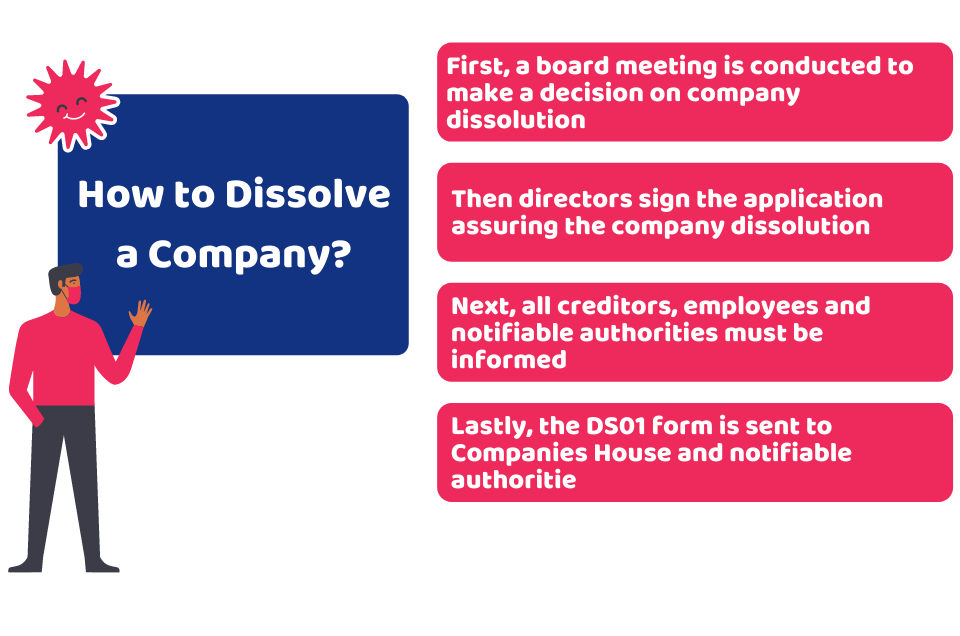

How to Dissolve a Company?

Dissolution of a company can be done by submitting a DS01 form that needs to be signed by a majority of the directors of the limited company. Then, this form needs to be sent to Companies House along with the relevant parties that need to be notified about your dissolution. These parties include your creditors, shareholders and employees. You also need to inform HMRC about your company’s dissolution.

Now you can do it online by accessing the Companies House website. A notice will be shown on your gazette declaring your decision to dissolve the company. Your company will be dissolved 3 months after the notice is displayed if there are no objections raised. Finally, the Gazette will run a final notice for the confirmation that your company is now dissolved.

Typically, these steps are followed to carry out a company dissolution:

- First, a board meeting is conducted to make a decision on company dissolution

- Then directors sign the application assuring the company dissolution

- Next, all creditors, employees and notifiable authorities must be informed

- Lastly, the DS01 form is sent to Companies House and notifiable authorities

What things to do before a Company Dissolution?

You need to fulfil the following responsibilities before closing your company:

- Ensure all the assets are shared among shareholders

- Pay employees their dues and follow the rules regarding redundancy

- Pay all taxes and liabilities outstanding

- File accounts and tax returns with HMRC

- Close down company payroll scheme and deregister for VAT by asking HMRC

- Confirm all debts and liabilities have been met

- Close the bank accounts of the company

- Inform all the notified parties, including HMRC and Companies House about your dissolution

Quick Sum Up

Hope you have got enough knowledge on how to dissolve a company. There are certain conditions you need to meet to close your company and in a few instances, you cannot close a company. You need to ensure that all these responsibilities and liabilities are met before closing down a company. Finally, you need to send DS01 to Companies House to strike off your name from the Register and need to send this to relevant authorities to notify them about your dissolution.

Want to dissolve your company? Get help from our cost-effective, reliable and experienced professionals at Accounting Firms to sort out your financial woes. Register now for free to connect in under three minutes!

Have a Query? Feel free to get in touch!

Disclaimer: This blog is written for general information about the topic.